Save More Money or Get Your Money Back

Break your bad financial habits, build new habits that help you save, and make meaningful progress towards your most important financial goals — all while enjoying the process.

Step 1: Watch This Video

Step 2: Book a Call

⭐⭐⭐⭐⭐

"Connecting with Charles was incredibly helpful in broadening my perspective on what I want my future to look like within the FIRE movement. It’s inspiring—and grounding—to talk with someone who’s actively doing the work that I’ve only been thinking about. It makes the whole path feel more real and a lot less intimidating."- Hernan Vargas

⭐⭐⭐⭐⭐

"I’d recommend it—especially to anyone feeling stuck or overwhelmed. The call offered practical advice and a fresh perspective that you don’t always get from books or videos."- Jeffrey Cormier

⭐⭐⭐⭐⭐

"I would recommend Charles to anyone I know seeking to gain financial literacy or perspectives on frugal living and financial independence. He is a good listener, is clearly passionate, and genuinely wants to help other people on their finance journeys!"- Matt Martino

Does this sound like you?

You've been working for years, but you have no savings to show for it

When money is in your bank account, it's hard not to spend it

You want to save, but don't have the discipline to do it

You don't know how to plan for expenses, much less plan for retirement

You don't where your money is going, and you're a little afraid to look...

You're not the only one...

How Grant TRIPLED His Monthly Savings and Built a Plan to Crush His $100,000 of Debt

How Libby Saved Thousands, Created Healthy Habits, and Built a Plan for Financial Freedom

⭐⭐⭐⭐⭐

"Charles has a deep understanding of the process to reach financial independence, including nuances of how life circumstances change over time. He got detailed with my situation and gave specific steps to help reach the goals I have! Charles answered all of my questions and gave me confidence in reaching financial independence."- Elizabeth Winchester

How I Learned to Love Saving Money

In 2017, I was lost in life, stressed about money, and anxious about my future.That's when my life changed.First, I set a goal of reaching financial freedom and living my dream life.Second, I slowly started to build the financial habits that helped me save money without even thinking about it.Third, I found a small group of people who helped me stay accountable.I didn't know it at the time, but these are the three key components of learning to love saving money.Now, I help others learn to love saving money, too. Here's how it works...

⭐⭐⭐⭐⭐

"Charles has a positive energy toward personal finances that is infectious. He not only knows what he's talking about and brings practical, powerful guidance but he talks about it with a genuine excitement that is motivating me to change!"- Julia Bulfin

How This Program Works

First, I'll help you set a goal that is meaningful to you using the S.M.A.R.T. Saver's Worksheet.Second, I'll help you take small but meaningful steps towards better habits and mindsets using the 4E/4H Framework that will rewire your brain to not just save money, but enjoy it.Third, I'll help you stick with it with daily or weekly check-ins (your choice) to ensure you're staying on track, motivated, and having a great time!And to thank you for giving me a chance to help you, the first 10 people will get free monthly one-on-one coaching calls for their first 3 months (normal price is $180).

How Much Does it Cost?

This program only costs $100 for 90 days of support.And here's the thing. I really want this to help, and I don't want your money if it doesn't. So, if this program doesn't help you reduce your expenses by more than the cost, I'll give you your money back.Worst case, you lose nothing. Best case, this helps you reach your financial goals years faster while helping you enjoy your life more. I want this to be a no-brainer.Still not sure if I can help? Here's what others have said...

Testimonials

⭐⭐⭐⭐⭐

"I would 100% recommend it. [It] gave me the clarity and direction I need to start taking action on my financial goals. Charles offered valuable insights that were both practical and easy to understand, which helped me feel more confident about my next steps. I just wish I’d found him earlier."- Vivian Obuekwe

⭐⭐⭐⭐⭐

"I would highly recommend [this]. It will help set me free and I already feel hopeful that life will be better"- Robyn Frazier

⭐⭐⭐⭐⭐

"[This] helped me understand a timeline for retirement and an approximate amount of money I need to earn to retire earlier."- Allison Benguiat

⭐⭐⭐⭐⭐

"Highly recommend it. Charles dispels the fear and shame around what is normally a really intimidating topic--especially for women--and makes it straightforward and practical. I left feeling empowered, hopeful, and excited. He was encouraging and to the point, and I excitedly called my best friend after to share the knowledge I had learned with her."- Eli Ketchum

⭐⭐⭐⭐⭐

"You're straight to the point and you practice what you preach! Would love to recommend you to anyone struggling with finances to people who need that extra optimization with their money!"- Alex Grobin

⭐⭐⭐⭐

"I would recommend it, it has been helpful for me and know others would benefit too. It gave me clarity and structure on what my next steps should be."- Anuj Sheta

⭐⭐⭐⭐⭐

"I found that my coaching call with Charles gave me peace of mind. It was so helpful to share my financial situation with someone who could quickly pick out the most important elements and show me how to make progress on the goals that I care about."- Bethany Roper

⭐⭐⭐⭐⭐

"It gives me a better picture of my financial future, and I believe I would have more confidence in my future self in the path to [financial independence]."- Keyu Zhang

⭐⭐⭐⭐⭐

"It opened up my eyes to other ways of thinking. You are kind and supportive of this journey of personal finance."- Kayze Manzon

⭐⭐⭐⭐⭐

"If you are looking to understand financial concepts and have a better understanding of what your financial goals are, Charles provides great understanding of concepts and wants to know your goals to know how he can better help you out. I had basic understanding of Roth IRA, 401K, HSA and he was able to go deeper into understand these concepts and tools."- Eduardo Garcia

$100,000 in Debt to Planning for Financial Freedom

When I first met Jasmine, she was in $100,000+ of debt.She had 4 credit cards, student loans, and debt-collectors knocking at her door.No budget. No emergency reserve.In our first meeting, she told me she was overwhelmed, constantly stressed about money, and didn't have a plan to reach her goals.Jasmine was highly motivated, but she didn't have a clear goal. She was also in the process of building good habits.So we worked together to create a prioritized list of steps to take Jasmine from where she was to where she wants to be.Now, Jasmine is saving ~50% of her income, and has a clear path to becoming debt-free and reaching financial freedom.

Client Case Study: How to Make An Extra $2.5M Without Working More

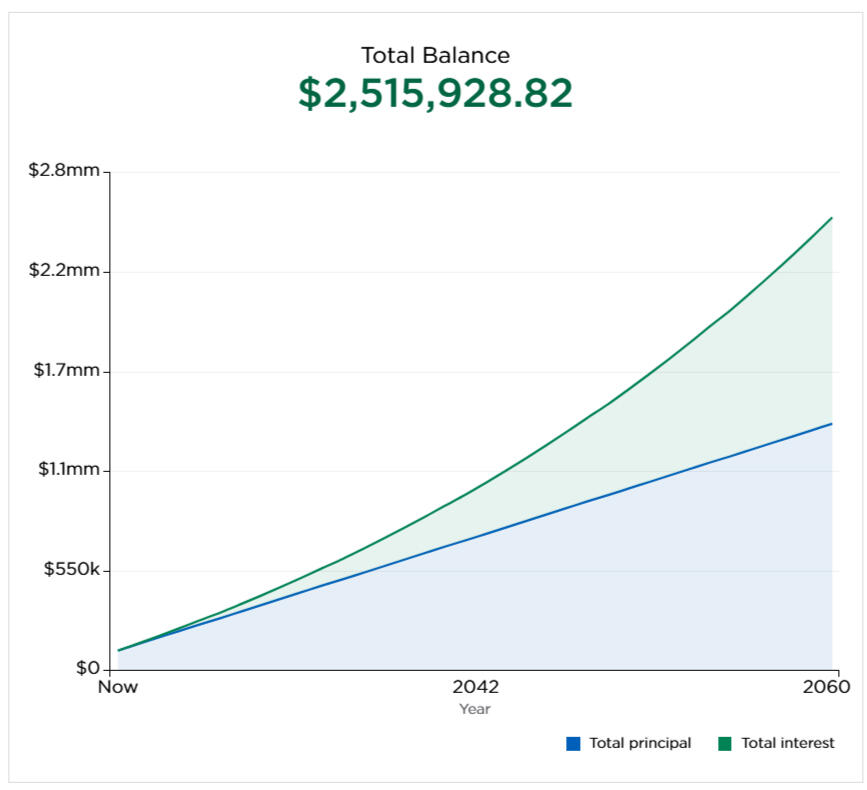

When I met Amanda, she was already doing a great job of saving... but she had no idea what to do with her money.Instead of using her hard-earned savings to build wealth faster, she was leaving her money in a savings account with low returns.Basically, she was leaving money on the table. A lot of money on the table.So I explained how Amanda could get far more out of her money. By investing her money, rather than letting it lose value to inflation in a savings account, Amanda has started to build the financial freedom flywheel that will eventually replace her income.I estimate that, by making that single change, Amanda may have an extra $2,515,928.82 by the time she reached retirement.Even better, that change only took 15 minutes.Not a bad return on her time...

Would You Recommend Something Like This to Others?

⭐⭐⭐⭐⭐

"I would definitely recommend! Charles is obviously very knowledgeable in personal finance and at the very least, you get a different perspective on your financial situation... he's genuinely trying to help!"- Ahmad Dannouf

⭐⭐⭐⭐⭐

"Yes! It was very helpful to talk with someone close to my age about the subject of financial literacy as many others in our age group aren’t interested in talking about retirement and finance. Thank you Charles!"- Jon Lee

⭐⭐⭐⭐⭐

"Yes. It's helpful to see and expose yourself to other perspectives... It helps you put words to thoughts that you keep in your head. It also helps you identify logical fallacies you may not be aware of, since your mind is an echo chamber. The only real hesitation that typically holds people back from doing so, is that people are afraid to go out of their comfort zone. "- Patrick Nguyen

⭐⭐⭐⭐⭐

"Yes, I think it would help people to become more frugal and to make better financial decisions."- Manuela Edreira

⭐⭐⭐⭐⭐

"I would highly recommend it. It would be beneficial to get advice from you who has already done it and close to reaching your financial freedom goal."- Mohammed Nabil

⭐⭐⭐⭐⭐

"Yes!! Absolutely. Charles was easy to talk to, and relatable. Very helpful in helping me to reach my goals."- Jasmin Lunn

⭐⭐⭐⭐⭐

"Yes, definitely would recommend it. Especially someone like myself that needs ample time to make decisions with how risk-averse I can be."- Natasha Brown

Client Case Study: Retiring by 40 on Minimum Wage

I truly believe that anyone can reach financial freedom. And Stanley is proof of it.Despite only making minimum wage, I helped Stanley get on track to reach financial freedom by the time he turns 40 years old!Inspired by my YouTube videos, Stanley was already building super savings systems by the time I first met with him.But Stanley's investments weren't optimized, meaning he was paying taxes on thousands of dollars that he didn't need to.I estimate that change will save him ~$1,000 per year, potentially resulting in an extra $25,000 by the time Stanley plans to retire!

⭐⭐⭐⭐⭐

"This coaching call was very helpful in identifying aspects of my particular situation that I may have overlooked without it."- Stanley Hodge

Ready to Build a Great Relationship with Money?

© Charles Broomfield. All rights reserved.